Georgia Continues Aggressive Mental Health Parity Enforcement, Fining Insurers Nearly $25 Million

Key Takeways

- Georgia is intensifying mental health parity enforcement with substantial penalties. The Georgia Insurance Commissioner’s January 2026 orders impose nearly $25 million in fines, on top of more than $20 million assessed in 2025, confirming that parity compliance is a sustained, high-priority enforcement focus, not a one-time review.

- Operational parity failures, not clinical judgments, are driving liability. The department’s findings centered on non-quantitative treatment limitations (“NQTLs”), including prior authorization, utilization management, benefit classification, post-service denials, and deficient member communications that treated mental health services more restrictively than medical or surgical care.

- Insurers and providers should expect ongoing scrutiny and corrective oversight. Georgia is pairing per-violation monetary penalties with mandatory corrective action plans and continued monitoring, while encouraging provider and consumer complaints — making proactive parity audits and documentation of compliant processes increasingly critical.

On January 12, 2026, the Georgia Insurance Commissioner announced nearly $25 million in fines against major commercial health insurers for violations of state and federal mental health parity laws. The penalties stem from a series of targeted market conduct examinations reviewing how insurers administered mental health benefits during calendar year 2022.

The January orders build on, and significantly expand, Georgia’s parity enforcement efforts. In August 2025, Commissioner John F. King separately announced more than $20 million in fines arising from earlier parity reviews, indicating a sustained and escalating focus on insurer compliance.

What Georgia Reviewed

According to the orders, the department examined insurers’ real-world administration of mental health benefits, including how claims were processed; when and how prior authorization and utilization management requirements were applied; how appeals and grievances were handled; and whether member communications, including explanations of benefits, met legal standards. The reviews were administrative and process-focused and did not assess individual clinical decisions. Instead, the question was whether insurers’ systems and operational practices treated mental health services less favorably than comparable medical or surgical care.

What the Department Found

Across insurers, the findings were strikingly consistent. The department concluded that insurers repeatedly imposed more restrictive rules on mental health services, particularly through prior authorization and utilization management requirements. The orders also cite problems with benefit classification, post-service denials or claim reprocessing based on unclear medical-necessity triggers, and deficiencies in member communications. These practices were found to violate Georgia’s Mental Health Parity Act and the federal Mental Health Parity and Addiction Equity Act, especially as they relate to non-quantitative treatment limitations (“NQTLs”).

The Fines

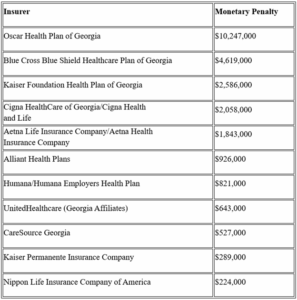

Penalties were calculated on a per-violation basis, rather than claim dollars or consumer harm. As a result, insurers with widespread process-level parity failures faced substantially larger fines, as reflected in the chart below.

In addition to monetary penalties, each insurer was ordered to cease imposing greater barriers on mental health services and to implement a corrective action plan, subject to ongoing oversight by the department.

A Pattern of Escalating Enforcement

The January 2026 orders follow Commissioner King’s August 2025 announcement of more than $20 million in parity-related fines, which arose from Georgia’s first mandatory mental health parity data call and subsequent market conduct examinations of 22 insurers. At that time, the department reported uncovering over 6,000 parity violations, many involving improper prior authorization requirements, inconsistent benefit classification, and unclear post-service medical necessity reviews. Commissioner King emphasized that insurers had “turned a blind eye” to parity obligations and warned that enforcement would continue. Together, the August 2025 and January 2026 announcements emphasize that Georgia views parity compliance as an ongoing regulatory priority, not a one-time corrective exercise.

Are the Orders Final?

Each January 2026 order was signed on January 8, 2026, with an effective date of January 9, 2026. The orders allow insurers to request an administrative hearing within 10 days of receipt. However, because the appeal window runs from receipt — not from the effective date — it is not yet clear from public information whether any insurer has requested a hearing. As of this writing, the department has not publicly indicated whether the 2026 orders are being challenged.

A Note for Providers

For providers, these enforcement actions offer a clear roadmap of where parity issues continue to arise. Common themes include aggressive prior authorization requirements, inconsistent utilization management rules, post-service denials with unclear justification, and inadequate explanations of benefits.

Providers who continue to encounter these issues may wish to track patterns carefully, particularly where mental health services appear to be treated more restrictively than medical or surgical care. The Insurance Commissioner has emphasized that parity enforcement is ongoing, and the department encourages providers and consumers to file complaints regarding any suspected parity violations.

For more information, please contact AGG Healthcare of counsel Tom Kelly.

- Thomas E. Kelly

Of Counsel